Introduction

The decision to rent or buy a house is one of the most significant financial choices many individuals face in their lives. In Sri Lanka, this decision is particularly critical due to various economic factors, making it essential to analyze the financial implications thoroughly. In this blog post, I’ll explain why, from a financial perspective, I would prefer renting a house over buying, aligning with Robert Kiyosaki’s notion that buying a house can often be a liability rather than an asset.

The Initial Costs

When you buy a house in Sri Lanka, you are faced with substantial initial costs, including the down payment, legal fees, stamp duty, and registration fees. These costs can quickly add up and consume a significant portion of your savings. On the other hand, when you rent a house, your upfront costs are typically limited to a security deposit and the first month’s rent. This allows you to keep more of your money working for you in other investments.

The Mortgage Dilemma

One of the primary arguments against buying a house in Sri Lanka is the burden of a mortgage. Taking out a home loan commits you to a long-term financial obligation, often spanning 15 to 30 years. During this time, a substantial portion of your income will be directed towards repaying the mortgage, leaving you with less disposable income for other investments or financial goals. As Robert Kiyosaki points out, this is where a house can become a liability.

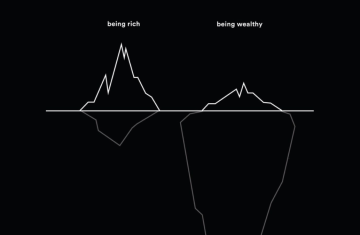

Opportunity Cost

The money you tie up in a house could be invested elsewhere for potentially higher returns. Sri Lanka has various investment opportunities, from stocks and bonds to businesses and real estate investment trusts (REITs). By renting instead of buying, you retain the flexibility to invest your money in avenues that generate income and appreciate over time.

Maintenance and Repairs

Another financial aspect to consider is the cost of maintaining and repairing a house. When you own a home, you are responsible for all upkeep expenses, from minor repairs to major renovations. These costs can be unpredictable and may strain your finances. When you rent, these responsibilities typically fall on the landlord, allowing you to budget more predictably and avoid unexpected expenses.

Risk Mitigation

Buying a house in Sri Lanka involves market risks. Property values can fluctuate due to economic conditions, location-specific factors, and changes in demand. If the value of your property depreciates, your investment may not yield the expected returns. By renting, you can avoid exposure to these market risks and focus on building a diversified investment portfolio.

Income Generation

While owning a property can provide rental income if you decide to lease it out, becoming a landlord comes with its own set of responsibilities and potential headaches. Renting out property in Sri Lanka requires careful tenant selection, property management, and legal compliance. This can be time-consuming and may not always result in a positive cash flow.

Conclusion

In my personal opinion, based on the financial context in Sri Lanka and aligning with Robert Kiyosaki’s perspective, renting a house can often be a more financially prudent choice than buying. It allows you to maintain flexibility, minimize upfront costs, and allocate your resources to income-generating investments. However, the decision ultimately depends on your specific financial goals, risk tolerance, and long-term plans. It’s crucial to conduct a thorough analysis and consult with financial experts before making such a significant decision in your life.